LargeOrangeFont

We aren't happy until you aren't happy

- Joined

- Sep 4, 2015

- Messages

- 49,689

- Reaction score

- 76,183

College kids Spend on hotels

College kids don’t own or can afford RE in Havasu or anywhere else in the southwestern US.

College kids Spend on hotels

They are lucky if they have beer money.College kids don’t own or can afford RE in Havasu or anywhere else in the southwestern US.

They are lucky if they have beer money.

We stayed at crazy horse back in the day

The comfort of a home vs. a hotel is subjective. I've stayed at some hotels that outweigh some STRs I have stayed at. Granted, in LHC, a hotel will unlikely beat an STR. Again you make my point that RDP is made up primarily of people with money, and the rest should go be poor somewhere else.If it is Havasu, several of us have our homes listed here on RDP for rates that are cheaper than going to a hotel, with no added fees. The comfort of a home, is far superior than a hotel IMO.

At the end of the day, this town is freaking packed and the money that is here in the winter isn't going to be staying at The Quality Inn...........

This time of year isn't college kids coming to party in the channel, so the vacancy rate of The Quality Inn isn't an accurate gauge of the Havasu economy.

That could come back to haunt LHC. It is the primary reason I am coming here in the Winter. I'm reminded of the fun I had.Yep. Havasu is not the college party destination it once was.

same thing happened to Lake Tahoe x 10000Yep. Havasu is not the college party destination it once was.

The comfort of a home vs. a hotel is subjective. I've stayed at some hotels that outweigh some STRs I have stayed at. Granted, in LHC, a hotel will unlikely beat an STR. Again you make my point that RDP is made up primarily of people with money, and the rest should go be poor somewhere else.

Your Winter Money comment is worth further debate. We have a thread lamenting the current increase in transient desert dwellers on this forum. It does not seem that that is the type of people that generate investment. It does not appear they are wanted here, but they are coming.

I spend six months at Islander among the snowbirds. I am lucky enough to be a remote worker. I learn a lot from my snowbird neighbors. IMHO, LHC will be in trouble when these people age out, which will soon happen. Boomers are almost at the point they can't travel. I do not see a lot of investment in attracting GenXers; even if they were, that demographic is small. That leaves the Millennials. How will LHC attract a demographic that does not like fast boats and offroad vehicles?

Snowbirds in Islander are dropping like flies. I suspect that is representative of the LHC winter money you speak of.

That could come back to haunt LHC. It is the primary reason I am coming here in the Winter. I'm reminded of the fun I had.

That is why all the empty nesters want to spend time or live there. The ones that relocate or own houses there will have the grandkids out there and spawn multiple generations of visitors.

Havasu will continue to be a landing spot for CA money for those able to escape.

My kids know nothing else. They want the boating and off road experiences to be a part of their lives. My kids enjoy havasu we have a great time there

same thing happened to Lake Tahoe x 10000

you gotta be a Jeff Bozo or Mark Cuckeburg to by a house there now

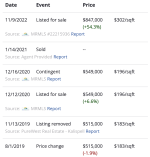

if I can still sell my CA home for 1.4 I would still pay the 800k for this home. It’s a domino effect at play. When I look at homes now the first thing I look at is the value at the beginning of 2020. That is the price I’d like to pay because that is where I see prices headingSomething else for your consideration.

Here is an example of a lovely home in Kalispell, Montana. I'm sure you could substitute many other areas in the west. In two years, the delta between asking prices Goes from about $550K to $850K. It does not appear a significant investment was made to increase the home's value in two years, save for inflation. (or speculation)

Setting aside mortgage rates (using the current rate), This home will cost an additional $60K in down payment from around slightly over $100K to $160K, and the monthly payment will rise about $1800 a month to nearly $5000 a month. The amount of qualified buyers for this home has dramatically diminished. You can't simply suggest a wealthy equity-rich buyer from out of state will move to this area because that option is tightening with remote work becoming less common and retirement-aged buyers facing a declining population.

View attachment 1184937

Please help me understand how the real estate market will not see a decline in prices. This house, I assume, like many, has a price driven up by speculation. The house is empty and will depreciate quickly as the weather is brutal on unoccupied homes no matter where it is located.

I may be naive, but a change in the interest rate does not price me out of the market as much as dramatic swings in home prices. While I would like to take advantage of rates as we saw in 2021, I believe those created more long-term harm to the economy than good.

If this home returned to 2020 pricing, would this be considered a crash? I think this simple question is the crux of disagreement in this thread. This would be a reduction in asking price from about $850K down to $550K (-$300K)

For some, I think this would feel like a crash; for others, it would feel like a return to normal.

FWIW: I feel this home would sell in hours if the house were priced at $699K, netting the buyer a healthy return on investment, but we don't know how much the mortgage is on this home. I suspect the buyer quickly took equity out of the house and bought additional properties. My gut tells me this is why we have not seen more significant price reductions and maybe the ticking time bomb.

How long before cash flow becomes a problem for the people that own empty homes? STR property that is sitting empty?

What is the actual value of this house? Whatever someone will pay, I guess?

304 Stoneridge Dr, Kalispell, MT 59901 | Zillow

304 Stoneridge Dr, Kalispell MT, is a Single Family home that contains 2807 sq ft and was built in 2005.It contains 4 bedrooms and 4 bathrooms. The Zestimate for this Single Family is $930,500, which has decreased by $5,203 in the last 30 days.The Rent Zestimate for this Single Family is...www.zillow.com

I guess I'm working the LAM angle pretty well.You are at the Islander for half the year with a SXS. You are one of the people with money

Islander is pricing out snowbirds for people like you… empty nesters with the ability to pay. You can get a house in town for the winter for much cheaper.

That is why all the empty nesters want to spend time or live there. The ones that relocate or own houses there will have the grandkids out there and spawn multiple generations of visitors.

Havasu will continue to be a landing spot for CA money for those able to escape.

My kids know nothing else. They want the boating and off road experiences to be a part of their lives.

Who the heck would want to stay at the Quality Inn when there are AirBNB for the same price???

I guess I'm working the LAM angle pretty well.

I hate to break the news to you, but Islander is not that expensive, and I will challenge you to provide an example of a residence I can purchase in LHC for cheaper than staying here at Islander.

Including my storage unit, I'm $2500 all in for monthly costs including rent, maintenance, insurance, and RV payment. I put $10K down on the RV.

Got a lead on an LHC residence for $10K down and $18K in annual costs?

The trouble is a generalization. All the empty nesters?

Classic AirBNB.. $199 a night, 2 nights for $398, pretty good deal. But then you add the fees and you're at $800.00

Chalet in Incline Village · ★4.81 · 3 bedrooms · 3 beds · 2 baths

Winter is Here! 3BR Retreat in Incline Villagewww.airbnb.com

Really an idiot shit we stay at the island hotel. We own 3 properties in havasu sons own two they stay as well at the island snow birds till April havasu is a great place to chill and make memories with your kidsI really don't understand why you respond this way. Perhaps it is my reading of your post, but it comes off as if anyone who stays at the Quality Inn instead of an Air BnB is an idiot. I realize it is difficult to express tone adequately in an online format.

I did a quick search.

View attachment 1184952

View attachment 1184953

View attachment 1184954

Please note the total price. The only ones close to $250 for 3 nights are rooms in someone else's house. Jeff's parents have a dog. That complicates things as well.

My in-laws stayed there because they are on a budget, they have a dog, it's close to a bar and restaurant and close to us. They've stayed in AirBnBs before, but that was not their choice for this trip.

Is that not a trailer in your example? I'm quickly becoming convinced I am an idiot because I just can't visualize a $100K single-wide mobile home in a park north of town gaining value and making me money. This is why I'm too poor for RDP. When I live there, I'll turn to a life of crime.I understand you live in your RV full time but do most of your neighbors? You are talking a buy vs rent situation and most snowbirds rent. We are also talking appreciating vs depreciating assets (Actual RE vs a RV or trailer)

Your sunk housing costs are sitting there in the space, most snowbirds have their sunk housing costs sitting back in the frozen north somewhere. Given that, $2500/month is relatively expensive to live in a parking spot down by the river for half the year. You can get a house with a hot tub for that.

That was why you saw snowbirds with decent rigs parked behind Wal Mart for years…..because it’s free. Those people are wondering why you are paying to park at the Islander.

It is all relative I suppose.

To answer your question… yes many leads. You could have this paid off in 4 years with your equation, renting it out when you aren’t there. After year 4 it is making money, vs costing $18k a year until the end of time.

There are many listings like this.

1100 Riverside Dr #216, Lake Havasu City, AZ 86404 | Zillow

1100 Riverside Dr #216, Lake Havasu City AZ, is a Single Family home that contains 420 sq ft and was built in 2006.It contains 2 bedrooms and 1 bathroom. The Rent Zestimate for this Single Family is $1,202/mo, which has increased by $1,202/mo in the last 30 days.www.zillow.com

Is that not a trailer in your example? I'm quickly becoming convinced I am an idiot because I just can't visualize a $100K single-wide mobile home in a park north of town gaining value and making me money. This is why I'm too poor for RDP. When I live there, I'll turn to a life of crime.

My Islander neighbors are split bout 50/50 between Full-time Rv and homeowners. The homeowners mostly own multiple revenue-generating properties. The full-timers sold mostly everything to fund the last blast before the glue factory. Mostly my neighbors are financially set at a level I will never achieve.

We can debate all we like on the web, one side is gonna be right and the other is going to try and explain that they claimed something different.

Just to be clear. I am praying, hoping, and doing voodoo dances that the economy crashes so hard people bleed, and housing tanks to unbelievable levels. BUT It's highly unlikely what I want will happen, so I will be satisfied with a return to 2019 prices.

There are a lot of factors that make each situation unique. Age plays a big part. While my job is pretty secure, my location is not. At a moment's notice, I may have to move to almost anywhere in the world. I chose to sell everything based on my previous history and what I know about my future. I'm in Havasu now, enjoying the weather and view, understanding that it could change. The last thing I wanted was to be stuck with a house and have to move. So I sold pretty close to the top.If it does not happen this next year, how long are you prepared to wait? What’s the opportunity cost of waiting? If is does happen this year, and you buy, what if it gets worse in 2024 and beyond?

You have first mover advantage now, but you probably won’t get bottom dollar

(whatever that will end up being).

If you bought in 2008 when opportunity was in the air, does that 10-15% price delta from 08 to 11 really even matter today?

I'm going with "Its going to get worse before it gets better" and am in no hurry to risk anything right now. I'm thinking 6-9 mths we'll have a much better idea of the opportunities.There are a lot of factors that make each situation unique. Age plays a big part. While my job is pretty secure, my location is not. At a moment's notice, I may have to move to almost anywhere in the world. I chose to sell everything based on my previous history and what I know about my future. I'm in Havasu now, enjoying the weather and view, understanding that it could change. The last thing I wanted was to be stuck with a house and have to move. So I sold pretty close to the top.

We have multiple topics in this thread; I'm still in the camp of people who think we should be careful. The economy does not seem to be built on a solid foundation. Those that say 2008 can't happen again are right; each situation is unique. For many, 2008 caused enough pain that it impacted people who might not usually feel the sting, but because the lead-up is different, there are clues that point to cracks in the foundation.

To answer your first question, I might have to wait or seriously downsize my expectations of what and where I want to buy and what I can buy. I'm actively shopping, but I've not seen "The forever Home." There are some deals to be had. We actually purchased a property in 2022.

If it does not happen this next year, how long are you prepared to wait? What’s the opportunity cost of waiting? If is does happen this year, and you buy, what if it gets worse in 2024 and beyond?

About as long as you'll wait for your Speed Car, I guessMaybe less.

I believe the probability of China invading Taiwan has exponentially increased in the last 24 months, as it has become apparent that Joe Biden and the Democratic clown show he assembled to govern has no idea how to formulate and execute a cogent and effective foreign policy response to the gathering clouds of war.ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

I believe the probability of China invading Taiwan has exponentially increased in the last 24 months, as it has become apparent that Joe Biden and the Democratic clown show he assembled to govern has no idea how to formulate and execute a cogent and effective foreign policy response to the gathering clouds of war.

The Chinese Communist Party (CCP) has a fully developed intricate plan to take over Taiwan, and will also continue to extend their influence across the world by providing money and expertise to developing countries. The Chinese are executing this plan through a foreign policy known as the Belt and Road Initiative.

China has been closely following Russia's invasion of Ukraine, and specifically the United State's reaction to Putin's aggressive and inhumane attacks that are targeting the civilian understructure. Biden's historical record of foreign policy failures has reached a new low with his handling of the conflict, and it is clear Russia has correctly deduced the US will not act to halt the aggressions being foisted upon the vulnerable civilian population.

It is obvious that Putin intends the outcome of the conflict to be victory on his terms. He will not participate in a negotiated settlement. Biden's continued escalation of the war by providing billions of dollars in cash and sophisticated military equipment will eventually force Putin to utilize tactical nuclear weapons on the battlefield.

When this threshold is passed, China will begin their invasion of Taiwan. The United State's inability to force containment of Chinese aggression will result in the establishment of a CCP government in Taiwan. The forgotten lessons of Communist governance will be brought into focus once again, with purges and executions slashing through the ranks of Taiwanese political and intellectual figures.

The Democratic focus on LGBTQIA+ () issues while World War III is beginning to boil could easily escalate to a catastrophe which will cause massive destruction and death. We can only hope that elections held in November 2024 will install a government that is strong enough to reverse the idiocy of the disastrous Biden presidency.

At the first hint of an invasion, I believe plans will be set in motion to evacuate top chipmaker talent, and I believe we will destroy the highest tech chip factories, leaving China with little to show for their efforts.

If China just stopped production of everything they export to the western nations it would be enormously crippling..

I believe they are doing these Covid lockdowns on a plan to see how had it hurts us..

If we get involved in them and Taiwan it’s gonna be a shit show and likely the beginning of WW3

For years I've wondered about the flooring plan costs for RV dealers. There are some stores located in small towns miles from a major market that have well over $3-$5 million in inventory.Surprisingly honest talk from an RV dealership. A bit long, but he shares some good stats about sales and manufacturing.

I disagree...I may be naive, but a change in the interest rate does not price me out of the market as much as dramatic swings in home prices. While I would like to take advantage of rates as we saw in 2021, I believe those created more long-term harm to the economy than good.

Absent a drop in wages, a 30 percent drop in housing prices will make it very difficult to bring new inventory upon the market.I disagree...

$600,000 last year @ 4% = $2,864/mo

$550,000 this year @ 6.5% = $3,792/mo

The 600k house mentioned above would have to drop to $450,000 to have a similar payment at 600k. That will be about a 30%+ decline from the top. While I do believe we will give back covid gains (20% ish), if prices drop 30% people will be buying again.

I am not as concerned with the monthly as I am in the 20% down requirements burning my cash. Somewhere in all this math is a tipping point where the 20% down payment increase for inflated pricing intersects with the increase in interest rates.I disagree...

$600,000 last year @ 4% = $2,864/mo

$550,000 this year @ 6.5% = $3,792/mo

The 600k house mentioned above would have to drop to $450,000 to have a similar payment at 600k. That will be about a 30%+ decline from the top. While I do believe we will give back covid gains (20% ish), if prices drop 30% people will be buying again.

Absent a drop in wages, a 30 percent drop in housing prices will make it very difficult to bring new inventory upon the market.

Lol I look at final price not advertised Airbnb which will have a cleaning fee anyways hotel in my case is still cheaper and less hassle. Besides I only need a hotel to just sleep.Who the heck would want to stay at the Quality Inn when there are AirBNB for the same price???

I am not as concerned with the monthly as I am in the 20% down requirements burning my cash. Somewhere in all this math is a tipping point where the 20% down payment increase for inflated pricing intersects with the increase in interest rates.

I would instead take the lower purchase price, property taxes, and transaction fees than see hyperinflation in the real estate market, as we have seen recently—refi on the rebound.

The barrier to entry hits the FHA/VA 3% down folks at the down payment and the monthly pretty hard, there is no doubt. Imagine all that and PMI?

I'm thinking of a conventional 20% down situation where the increase in interest might play a different role in the trade-off. Someone way more intelligent than me could likely whip up some quick stats that point to how an 18% home loan was not such a big deal when the house price was $30K

That's assuming you keep the house and the mortgage. Smart Money may agree that the lower interest rate is more attractive even at the higher costs of the home. I'm just willing to trade higher interest rates in exchange for the reduction of speculative buyers driving up the costs of homes. Too much OPM (other people's money) in the system seemed to turn people into spending like drunken sailors. The Cheapest apple video comes to mind.That $900 more a month on a lower purchase price with higher interest would only hurt your cash for 3 years in that scenario vs. the higher price/lower interest. Then it is 27 years of having an extra $900/month.

That seems like a decent trade off to paying $900 more a month in interest for 30 years hoping for a drop in rates.

Although you don’t really have a choice unless you have a time machine I suppose.

I’d put more down on a higher price/lower interest deal like that every time.

Every situation is different..That's assuming you keep the house and the mortgage. Smart Money may agree that the lower interest rate is more attractive even at the higher costs of the home. I'm just willing to trade higher interest rates in exchange for the reduction of speculative buyers driving up the costs of homes. Too much OPM (other people's money) in the system seemed to turn people into spending like drunken sailors. The Cheapest apple video comes to mind.

I hope we agree that each situation is unique, but let's assume the life cycle of a mortgage into the equation.

This morning I was thinking about two scenarios and which I would rather be in.

Let's imagine the same house in Austin, Texas. I work for SalesForce Dual income family with two and a half kids. My wife works as a Real Estate Sales Person.

Scenario 1.)

I bought at the top of the market and moved here for a tech job. Low-interest rate, but now I am $75K underwater. No biggie, It costs about the same as rent in this town.

Scenario 2.)

Paying a higher interest rate, and the mortgage payment is slightly higher than rent, but I have $75K in equity.

Today I got my pink slip because Salesforce is cutting 10% of the workforce. I will lose my medical insurance; my wife will have to go on maternity leave. I have a job offer in California. The RE market is a train wreck, the wife has not sold shit in two months, rental market is flat. I've got two new cars that are upside down.

I may not have learned how to make a lot of money, but I have learned that having an escape plan has served me well over the years without bankruptcy or repossession.

I'm not convinced the low-interest rate will be much of an influencing factor for the above examples.

One of the Silverbacks in the park told me yesterday he sold two short sales a week in one year during the great recession. He felt like those days are going to return.

It's taken 50 years for me to learn to listen to my elders.

I’d want the scenario with the equity it gives you the ability to sell easily and move if you need to. Also can refi later. Also slight negative rental cash flow not a big deal as you are also paying down principal so not a true negative.That's assuming you keep the house and the mortgage. Smart Money may agree that the lower interest rate is more attractive even at the higher costs of the home. I'm just willing to trade higher interest rates in exchange for the reduction of speculative buyers driving up the costs of homes. Too much OPM (other people's money) in the system seemed to turn people into spending like drunken sailors. The Cheapest apple video comes to mind.

I hope we agree that each situation is unique, but let's assume the life cycle of a mortgage into the equation.

This morning I was thinking about two scenarios and which I would rather be in.

Let's imagine the same house in Austin, Texas. I work for SalesForce Dual income family with two and a half kids. My wife works as a Real Estate Sales Person.

Scenario 1.)

I bought at the top of the market and moved here for a tech job. Low-interest rate, but now I am $75K underwater. No biggie, It costs about the same as rent in this town.

Scenario 2.)

Paying a higher interest rate, and the mortgage payment is slightly higher than rent, but I have $75K in equity.

Today I got my pink slip because Salesforce is cutting 10% of the workforce. I will lose my medical insurance; my wife will have to go on maternity leave. I have a job offer in California. The RE market is a train wreck, the wife has not sold shit in two months, rental market is flat. I've got two new cars that are upside down.

I may not have learned how to make a lot of money, but I have learned that having an escape plan has served me well over the years without bankruptcy or repossession.

I'm not convinced the low-interest rate will be much of an influencing factor for the above examples.

One of the Silverbacks in the park told me yesterday he sold two short sales a week in one year during the great recession. He felt like those days are going to return.

It's taken 50 years for me to learn to listen to my elders.

I’d want the scenario with the equity it gives you the ability to sell easily and move if you need to. Also can refi later. Also slight negative rental cash flow not a big deal as you are also paying down principal so not a true negative.

tech guys like to own newer houses to keep maintenance low.I’d argue that slightly negative cash flow on a rental is a true negative with maintenance rolled into it.